How the tax team got a seat at the fleet table

Key Facts:

| Organisation: Australia Post | Number of Suburbs: 5,400 |

| Fleet Size: 452 | Vehicle Use: Commuter vehicles, assigned and pool |

| Location: Australia wide | Vehicle Type: Passenger vehicles |

| Website: https://auspost.com.au/ | LBM Products: Logbooks, Pool Bookings |

“When I was first asked about the Passenger Fleet, our CFO at the time wanted to know how we could get the FBT (Fringe Benefit Tax) number lower. I knew we could do a lot of work to manage the FBT and find some savings or, if we looked at Passenger Fleet management, the savings could be significant and ongoing.”

Peter Dimech, Head of Taxation, Australia Post

Australia Post is a self-funded government business enterprise that provides retail and delivery services to connect people within Australian communities to each other and the world.

The organisation has an extensive team of over 64,900 members, who worked together to process over 2.7 billion items in the 2021/22 period. The organisation facilitates these deliveries using over 17,000 vehicles including e-bikes.

Of these, 452 small passenger vehicles are used for team member commuting (the Passenger Fleet) and have been a core focus area for Peter Dimech, Head of Taxation for Australia Post, since 2016.

“As Head of Tax, I have no role in the actual management of the fleet. My role is theoretically limited to managing our FBT exposure,” says Dimech.

“When I first looked at the Passenger Fleet, it was clear that we should explore how an electronic logbook could be used to deliver better FBT outcomes for the fleet.

“Seven years later, the data we have gathered to perform the FBT management has been utilised to drive the conversation around Passenger Vehicle fleet optimisation and brought us a seat at that table.”

Fleets and Finance: Australia Post’s Journey

All finance professionals will be familiar with Fringe Benefit Taxes (FBT) on motor vehicles – whether they like it or not. The information and data needed for this process is often delivered to the finance team in dribs and drabs, meaning that FBT can be an extremely arduous, manual process.

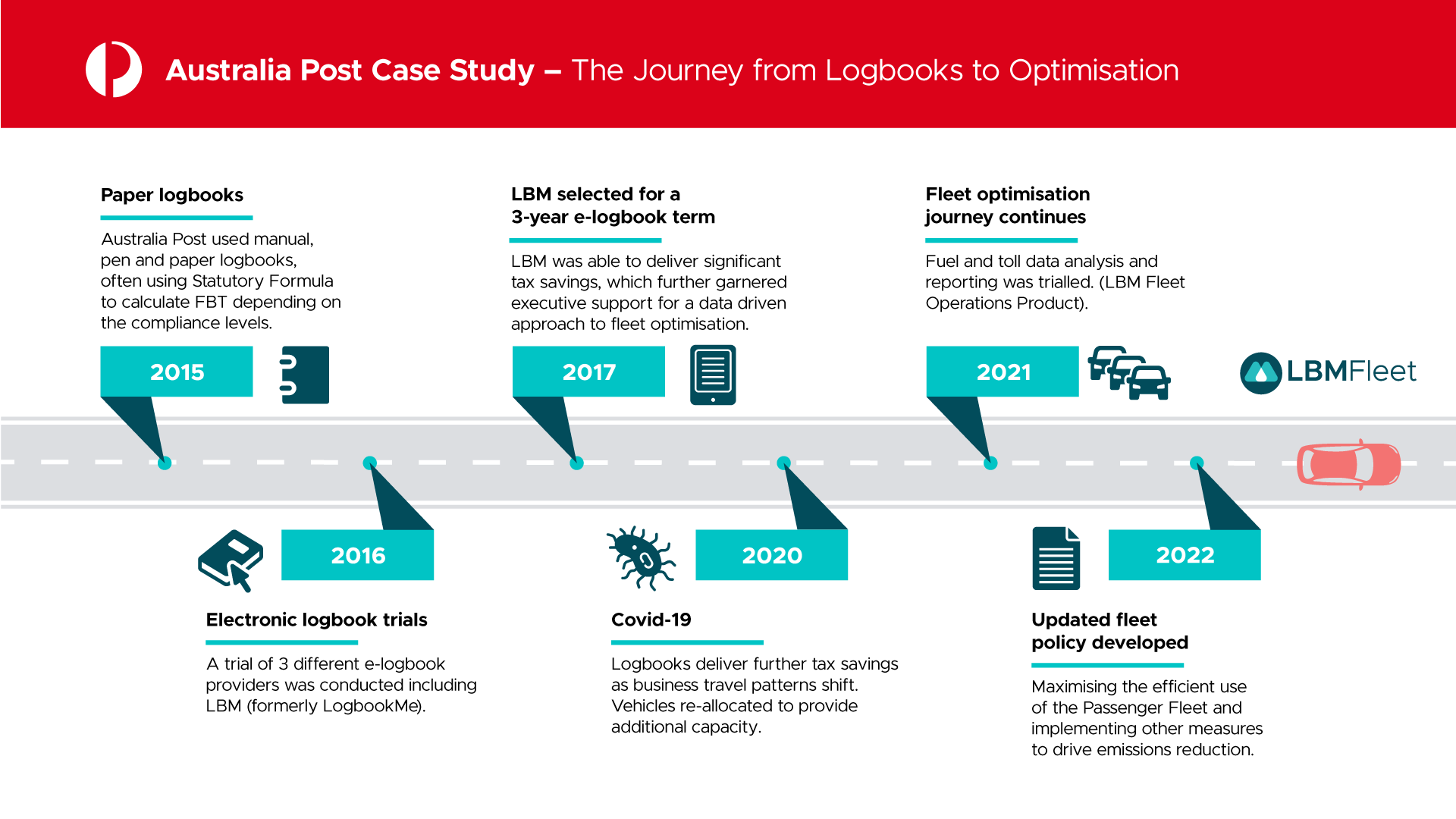

Prior to 2016, Australia Post was using a pen-and-paper manual logbook system and often using the Statutory Formula Method. This resulted in higher FBT costs than if valid logbooks had been obtained.

To prevent a repeat of this outcome, Dimech trialled several electronic logbook solutions and, in 2016, selected LBM Fleet (formerly Logbookme) as Australia Posts’ logbook provider.

“LBM was chosen for several reasons beyond the cost saving element, including accurate tracking, in-depth data analytics and reporting, and team engagement with the platform,” says Dimech.

“We planned to use the system initially for at least 2-3 years, as we knew from the trial that the LBM system would provide us with data that not only provided significant tax and time savings but would be a window to policy setting and strategic fleet management.”

Peter Dimech, Head of Taxation, Australia Post

Easy to use LBM platform delivers immediate results for Australia Post

With LBM Fleet’s support and guidance, Australia Post got their set up close to right from the beginning.

“The LBM app was adopted easily by the team, with drivers adapting quickly, classifying their trips as personal or business from the start,” says Mr Dimech.

“The easy one-touch trip classifier, driver notifications and pre-coded trips made the take-up of the system very manageable and seamless.”

Peter Dimech, Head of Taxation, Australia Post

Key to the success of the transition was also the engagement and communication process with staff, he says.

“We cascaded the message, first getting senior management onboard, then line managers. By the time drivers were onboarded, there had been a lot of conversations.”

As expected, there were queries about having tracking devices in the vehicles. But LBM’s in-built privacy settings ensured location details on personal and unclassified trips were masked.

“Australia Post has been required to, and able to demonstrate this, and it is now accepted that the devices are about reporting on business use for the operation.”

When asked about the initial remit to find FBT savings, Dimech says the project paid for itself.

“Since the first year we had LBM devices, FBT has always met the full cost of the devices and then more – we got to the point where we were essentially gaining a free service of data analytics. There has been an annual benefit, which has grown each year.”

Logbook data – the window to fleet optimisation

Over the next three years, the Australia Post tax team continued using LBM’s logbook, harnessing the data collected by LBM to develop new policies to improve the utilisation of the Passenger Fleet, and acting in an advisory role to optimise fleet performance.

“We can say that car did 10,000 kms this year, 7,000 was business, 3,000 was personal, the why and the how. There’s an ah-ha moment around that, the first part is about numbers and then, because of LBM, we can turn those numbers into insights.”

The advisory role continued to expand contemplating scenarios such as:

- Do we need to acquire more vehicles, or can we reallocate an existing one?

- What is appropriate and reasonable use? Should employee contributions be made?

- Should personal use be covered under company insurance policies?

- How can we get accurate reporting on the true cost of motor vehicle benefits for staff?

The LBM data and reporting system, combined with the resources of the finance team to manage fleet, has created a trusted relationship between Dimech’s team and other teams within the organisation, positioning the taxation team as strategic advisors on Passenger Fleet management.

“We frequently get questions from senior internal stakeholders about the fleet. This is often when there is an opportunity to challenge the status quo or advise on new policy,” he says.

“Having meaningful data has allowed us to provide this service internally as advisors driving optimisation of the Passenger Fleet.”

Innovation and the impact of Covid-19

Peter and his team again observed the benefits of the LBM system when the Covid-19 pandemic hit Australian shores. During this period, Australia Post saw a change in the usage of cars due to an unprecedented number of parcels being sent and staff no longer travelling to the office. This resulted in an increase in business usage across the Passenger Fleet, with vehicles clocking more business and fewer private kilometres than ever before.

According to Dimech, without the LBM logbook, this usage pattern would have gone unmapped and unrecorded, especially due to the extenuating circumstances of the time, and the priorities of individual drivers.

“The LBM system automatically picked up this increase, which led to a further reduction in FBT for the Covid period, for an estimated $250k-$300k total annual saving.”

Peter Dimech, Head of Taxation, Australia Post

Australia Post was also able to use LBM data to identify additional capacity and this was used to support decisions to re-deploy vehicles within the Passenger Fleet to optimise usage and deliver essential services.

By this time, Australia Post had expanded its services with LBM far beyond the Logbook, with the introduction of other data capture features to improve performance, such as toll reporting and fuel reporting.

“We were an early adopter of using the tracking information for our toll reporting. The savings from this are also significant, plus the savings in effort.

“We are now confident that our toll reporting is correct and don’t need to collect manual declarations. We also applied a similar system to fuel reporting, to firm up these reports as much as possible.”

BAU in 2022 Onwards – Strategic Fleet Management

Seven years on from implementation, LBM has not only allowed the finance team to have a hand in the strategic management of the Australia Post Passenger Fleet but has increased the executive team’s involvement and interest in the fleet with a focus on sustainability. Dimech credits his team and LBM’s support over the period.

“We can always pick up the phone to LBM Fleet. I catch up with the LBM team about once a month and one of the people in my team catches up with LBM almost every week,” he says.

“LBM come to us with insights and are a second pair of eyes. They project manage the catch-up on classifications, device installations, highlight new trends and are always raising the bar on product enhancements to deliver innovation and value.”

Peter Dimech, Head of Taxation, Australia Post

Australia Post developed a new Passenger Fleet Policy in 2022 covering vehicle eligibility, logbooks, reasonable use, vehicle sharing, maintenance and many other aspects of fleet.

This policy focuses on maximising Passenger Fleet efficiency and other measures to drive cost and emissions reduction and improve sustainability, helping to ensure the long-term viability of the organisation.